owe state taxes california

Looking to file your state tax return. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

Https Irsprob Com Irsprob Com Wins Again 2 Internal Revenue Service Cpa Irs

To check the status of your California state refund online go to httpswebappftbcagovrefundlogin.

. 5110 cents per gallon of regular gasoline 3890 cents. There is a 10 penalty for not filing your return andor paying your full tax or fee payment on time. Owe Taxes to the IRS.

If youre required to make estimated tax payments and your prior year California adjusted gross income is more than. Ad Explore state tax forms and filing options with TaxAct. Taxes are not the same in each state they are calculated differently.

Common Reasons Taxpayers Owe Money to the California Franchise Tax Board. If you had money. Then you must base.

Get Your Max Refund Today. Your maximum refund guaranteed. Federal tax brackets go from 10 for incomes between 10000 and 19999 to 37 for those earning more than 523600.

The undersigned certify that as of July 1 2021 the internet website of the Franchise Tax Board is designed developed and maintained to be in compliance with California Government Code. You didnt defer or you deferred. California State Tax Quick Facts.

If YOU did not pay the state tax due and have bankcredit card records to prove it then you still owe. How do I check if I owe California state taxes. How much taxes do I pay in California.

TaxAct can help file your state return with ease. California state tax rates are 1 2 4 6 8 93 103 113 and 123. Paying taxes owed to the state of California can be completed either online in person by mail or by telephone.

A 1 mental health services tax applies to income exceeding 1 million. Compare 2022s 5 Best Tax Relief Companies See if You Qualify. Your 2019 State Tax Withholding was lower than 2018.

Contact the California Franchise Tax Board at the Web page linked to above or call 800 689-4776 during business hours to learn more. 75000 if marriedRDP filing separately. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

073 average effective rate. Every effort has been made to offer the most correct. You can get up to 3027.

There are also states that apply no income tax but they still have ways to collect money. The state of California requires you to pay taxes if you are a resident or nonresident that receives income from a California source. Why do I owe state taxes California.

If you do not owe taxes or have to file you may be able to get a refund. The California Franchise Tax Board is responsible for. The simple answer to the question is yes you can work in California without being considered a resident.

Below are additional reasons why you may owe state income tax compared to last year. If you qualify for the California Earned Income Tax Credit EITC 7. Both personal and business taxes are paid to the state.

However generally you are still required to pay taxes on income. If you live in the. In California the lowest tax bracket is.

Ad Theres No Need To Be Scared of The IRS - The Best Tax Relief Companies On Your Side. Do I owe state taxes in California. What happens if you owe California state taxes.

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Do You Live In The State Of California And Have Not Filed Your Income Tax Returns In A Few Years Has The Irs Been Co Business Tax Income Tax Return Income

Understanding California S Property Taxes

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop

You Didn T Pay Whether You Forgot Or You Just Didn T Have The Funds So The Board Will Use All Means Necessary To Get The Money Y Tax Lawyer Tax Attorneys

California Use Tax Information

California Sales Tax Small Business Guide Truic

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Tax Solutions 455 Moraga Rd Suite B Moraga Ca 94566 925 376 6100 Coupon For Free 2nd Year Tax Return With Paid 1st Year Return At 5a Tax Return Moraga Tax

Jax Taylor S Salary From Vanderpump Rules Is Revealed As He Fails To Pay Off 1 2 Million Tax Debt Vanderpump Vanderpump Rules What Is A Father

California Tax Rates H R Block

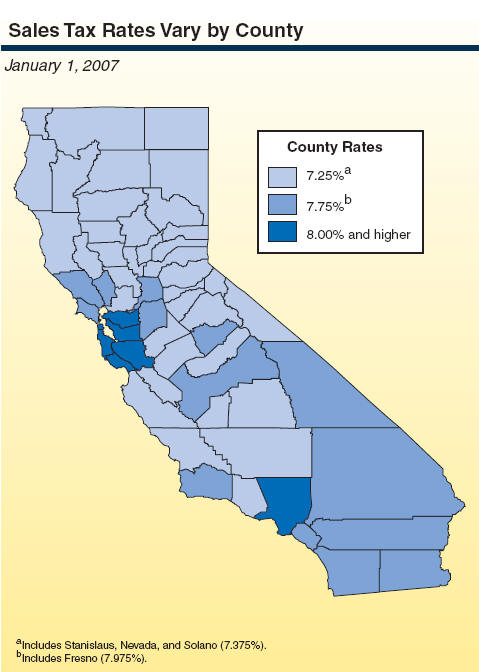

Understanding California S Sales Tax

I Owe California Ca State Taxes And Can T Pay What Do I Do

W4 Form Explained 4 Important Life Lessons W4 Form Explained Taught Us Tax Forms W2 Forms Income Tax

Scv News Lookup Table To Help When Filling Out California Income Tax Return Scvnews Com

California S Tax System A Primer

California S Tax System A Primer

Owe Money To The Irs Use These 4 Steps To Pay Off Your Tax Bill Owe Money Tax Debt Tax